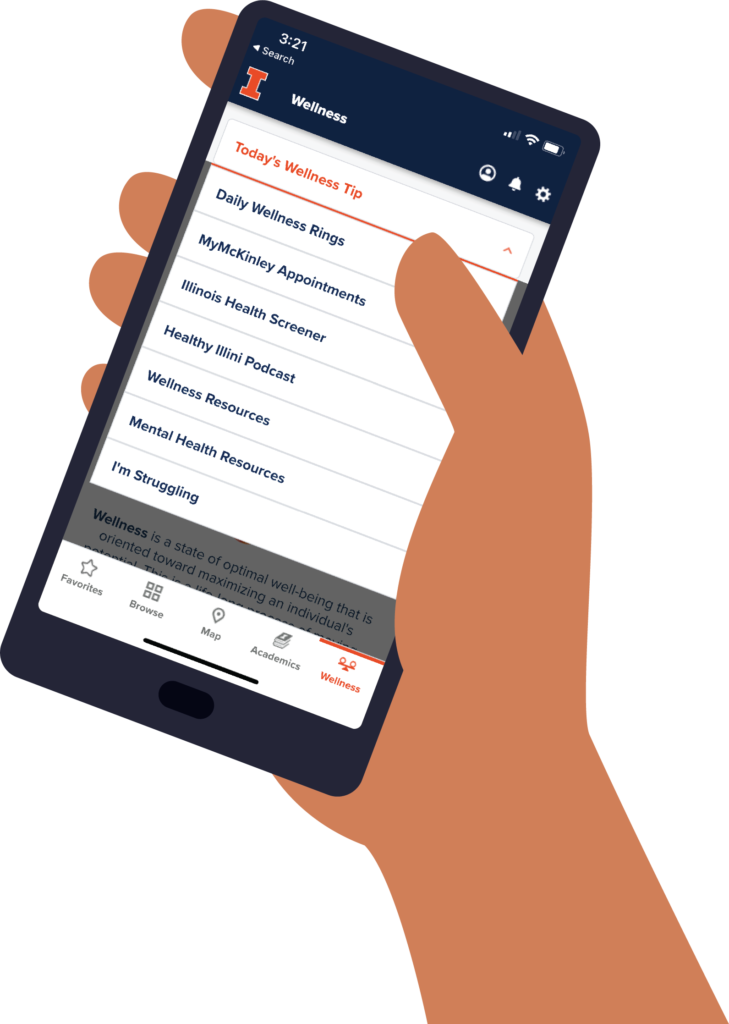

The Wellness section of the Illinois app connects you to resources that support your health and well-being. To find these tools, tap Wellness in the toolbar at the bottom of your app screen.

See Also

Features

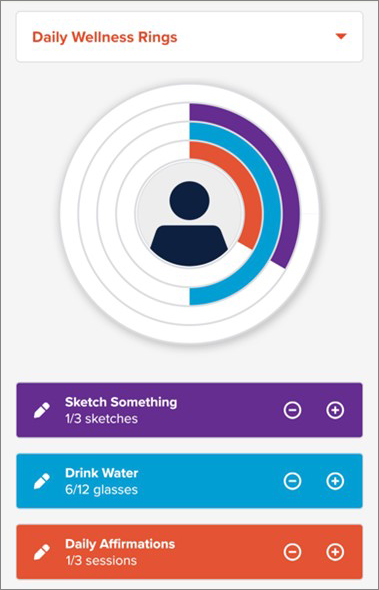

Daily Wellness Rings

The rings support and motivate you to establish new habits and healthy routines. How to use.

Healthy Illini Podcast

These 15-20 minute podcasts help to “Keep You Well to Excel” in and out of the classroom.

Tune in to hear healthcare professionals, campus experts, and students on timely health topics. How to use.

Illinois Health Screener

Take inventory of concerning symptoms and get suggestions on what you should do when you don’t feel well. How to use.

I’m Struggling

Check for help here when you’re feeling anxious and overwhelmed, but you don’t know where to go or who to talk to. How to use.

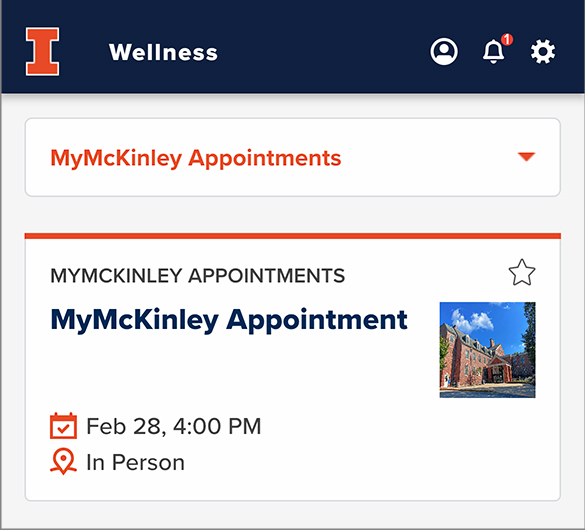

MyMcKinley Appointments

View your upcoming healthcare appointments and add them to the calendar app on your device. How to use.

Wellness Resources

Browse a comprehensive list of all the campus resources that relate to physical health, fitness, nutrition, mental health, and crisis management. How to use.